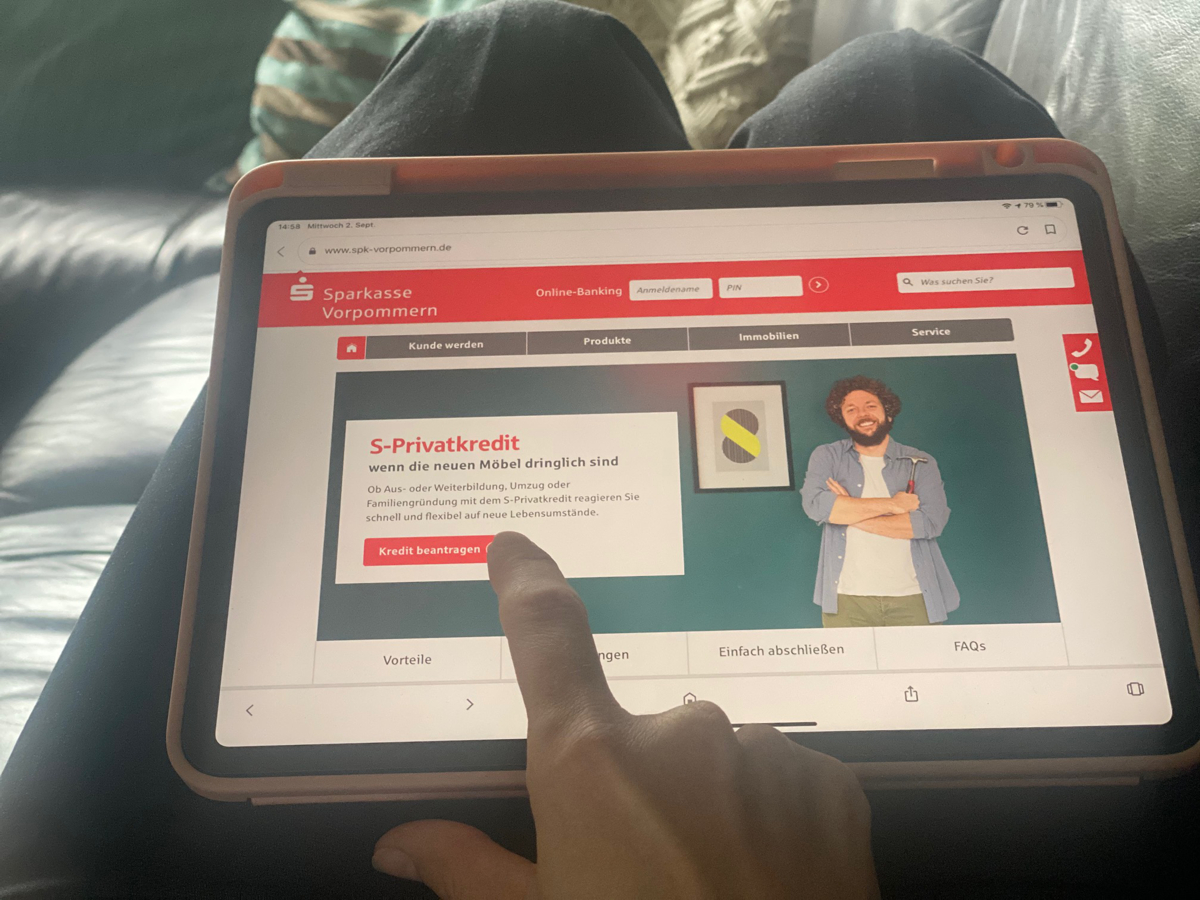

Welcome to SKPK.de, a trusted partner for quick, convenient, and responsible loan services. Whether looking to finance a new project, manage unexpected expenses, or simply need a financial boost, SKPK.de has the solution. Explore the extensive range of credit options, understand the application process, and find out why choosing SKPK.de is the best decision for financial needs.

Kredite: The Perfect Loan for Every Need

At SKPK.de, finding the right loan has never been easier. From personal loans to auto loans, and from small credit to immediate loans, there’s a perfect fit for everyone.

- Privatkredit: Ideal for personal expenses and investments.

- Autokredit: Perfect for financing a new vehicle.

- Ratenkredit: Spread the cost of large purchases with manageable installments.

- Online-Kredit: Quick and easy online applications.

- Kleinkredit: Small loans for immediate needs.

- Sofortkredit: Fast approval and immediate disbursement for urgent financial requirements.

Kreditaufnahme: Simple and Straightforward Loan Application

Applying for a loan at SKPK.de is designed to be as simple and stress-free as possible. The process is streamlined into four easy steps:

- Wunschkredit berechnen: Calculate the desired loan amount.

- Formular online ausfüllen: Fill out the online application form.

- Vertrag elektronisch unterschreiben: Electronically sign the contract.

- Auszahlung direkt aufs Sparkassen-Konto: Receive the funds directly in the Sparkasse account.

FlexiGeld: Flexible Money for Every Situation

Flexibility is key when it comes to managing finances. With FlexiGeld, there is the freedom to decide how to use the loan. Whether it’s home renovation, a dream vacation, or unexpected medical expenses, FlexiGeld provides the flexibility to cover various needs.

Vorteile im Überblick: Benefits at a Glance

Choosing SKPK.de comes with a plethora of benefits designed to enhance the borrowing experience:

- Complete Online Processing: Handle everything from the comfort of home.

- Low Rates through Long Durations: Enjoy lower monthly payments by extending the loan term.

- Freedom of Use: Decide freely on the use of the loan amount.

- Instant Credit Decision: Get an immediate decision on the loan application.

- Flexible Repayment: Make additional repayments anytime without penalties.

Fußballfieber mit Heimvorteil? Score Big with SKPK.de!

Football fever can strike at any time, and with SKPK.de, enjoy the games with peace of mind. Use the loan to upgrade a home entertainment system, buy tickets for the big match, or even travel to support the team. With SKPK.de, there’s always a winning side.

Kreditbetrag: Flexible Loan Amounts

With SKPK.de, choose a loan amount that best suits needs. Loan amounts range from €1,000 to €80,000, giving the flexibility to borrow exactly what is needed.

For example:

- Loan Amount: €20,000

- Term: 108 months

- Monthly Payment: €249.52

- Total Amount Repayable: €26,947.96

Product Features

- Nominal Interest Rate: 5.36% – 13.56% p.a. (depending on creditworthiness)

- Effective Annual Interest Rate: 5.49% – 14.44% (depending on creditworthiness)

A representative example:

- Net Loan Amount: €15,000

- Term: 72 months

- Monthly Payment: €281.47

- Total Amount Repayable: €20,266.15

- Nominal Interest Rate: 10.47% p.a.

- Effective Annual Interest Rate: 10.99%

Besser mit uns: Better With SKPK.de

Choosing SKPK.de means opting for a partner committed to responsible lending and customer satisfaction. Enjoy a hassle-free loan experience with expert support and guidance.

Voraussetzungen für Ihren Antrag: Eligibility Requirements

To apply for a loan with SKPK.de, ensure the following requirements are met:

- At least 18 years old

- Resident in Germany

- Have a Sparkasse checking account

- Use online banking for the Sparkasse checking account

- Salary or pension is credited to this account

Datenschutz and Responsibility: Secure and Responsible Lending

Data security is a priority. SKPK.de is ISO 27001:2013 certified, ensuring information is processed securely. The commitment to the “Responsible Lending” code also protects customers from over-indebtedness.

Customer Testimonials

Don’t just take our word for it. Here’s what customers have to say:

- “Uncomplicated processing without additional documents as an existing Sparkasse customer.” – Check24

- “The loan was approved within 5 minutes and the money was there after 1.5 hours. Absolutely exemplary compared to the competition! Would do it again anytime!” – Google Review

- “No bureaucracy, very fast and the best conditions for me. Sparkasse TOP and the employees professionally prepared, friendly and reliable!” – Google Review

Frequently Asked Questions

Explore the FAQ section for answers to common questions about the loan application process, eligibility requirements, and more.

Contact Information

Need help or prefer personal advice? Call 030 620 080 8070. Assistance is available every step of the way.

Final Thoughts

With SKPK.de, securing a loan is easy, quick, and reliable. Embrace financial freedom today by exploring the loan options and finding the perfect fit for specific needs. Calculate a loan now and take the first step towards achieving financial goals.

Explore SKPK.de today and discover the power of flexible, responsible lending. Because with SKPK.de, it’s about more than just money. It’s about making dreams come true.