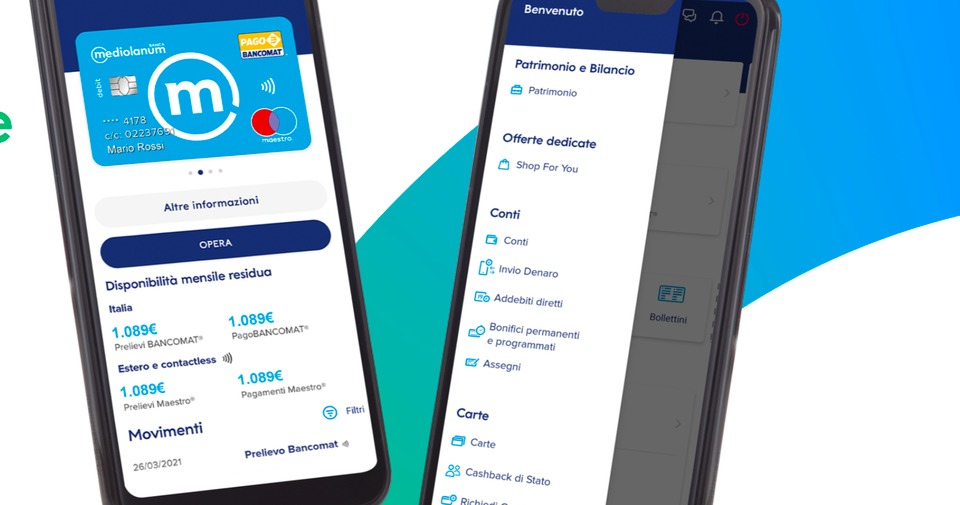

In the ever-evolving landscape of the banking industry, Banca Mediolanum has set a new standard with the introduction of SelfyConto, a groundbreaking digital banking solution that empowers users with unprecedented autonomy and convenience. SelfyConto represents a paradigm shift in the way individuals manage their financial transactions, providing a seamless online banking experience that transcends geographical boundaries and time constraints. With a comprehensive range of innovative features and personalized services, SelfyConto has emerged as a beacon of digital transformation, catering to the diverse needs and preferences of contemporary consumers.

Embracing Digital Autonomy

SelfyConto embodies the essence of digital empowerment, offering users the freedom to conduct their banking operations autonomously, efficiently, and securely. With a user-friendly interface and intuitive navigation, clients can effortlessly manage their daily banking tasks, from fund transfers to bill payments, with just a few clicks. The platform’s accessibility across various devices enables users to stay connected to their finances on the go, ensuring a seamless and integrated banking experience that aligns with the fast-paced lifestyle of modern individuals.

A Comprehensive Banking Ecosystem

More than just a conventional current account, SelfyConto introduces a comprehensive banking ecosystem that integrates a range of supplementary services and solutions to cater to diverse financial requirements. Alongside the core banking functionalities, SelfyConto offers users access to a personalized card, an insurance policy, and an array of other digital solutions that enhance the overall banking experience. This holistic approach fosters financial inclusivity and empowers users to leverage a spectrum of financial tools and resources, all within the confines of a single digital platform.

Investment Opportunities and Financial Growth

In line with its commitment to fostering financial growth and prosperity, SelfyConto introduces an array of investment opportunities that enable users to optimize their financial portfolios and explore the potential of the global markets. The “Double Chance” feature offers users promotional interest rates on uninvested funds, facilitating gradual entry into the global market through a dedicated investment plan. With a focus on transparency and tailored financial guidance, SelfyConto equips users with the necessary tools and insights to make informed investment decisions and secure their financial future effectively.

Empowering a Sustainable Future

Banca Mediolanum’s ethos of sustainability and social responsibility is seamlessly integrated into the SelfyConto experience. The platform encourages users to make environmentally conscious financial choices and invest in sustainable initiatives that contribute to a greener and more sustainable future. By promoting sustainable investment options and fostering awareness of environmental preservation, SelfyConto exemplifies the fusion of financial prosperity with ecological consciousness, fostering a community of responsible and conscientious investors committed to creating a positive impact on the planet.

Innovation in Customer Satisfaction

Rooted in a culture of customer-centricity, SelfyConto is designed to cater to the evolving needs and preferences of its users, prioritizing seamless digital experiences and personalized financial solutions. With a dedicated focus on enhancing customer satisfaction, the platform continually integrates user feedback and market insights to refine its services and introduce innovative features that anticipate and fulfill the evolving demands of the digital banking landscape. SelfyConto’s unwavering commitment to excellence and customer satisfaction sets a precedent for the industry, showcasing the transformative potential of technology in redefining the banking experience.

Empowering Financial Education and Literacy

In addition to its emphasis on providing comprehensive financial services, SelfyConto is dedicated to fostering financial education and literacy among its users. Through accessible resources, informative content, and interactive tools, the platform empowers users to enhance their financial acumen and make informed decisions regarding their financial well-being. By promoting a culture of financial literacy, SelfyConto aims to equip individuals with the necessary knowledge and skills to navigate the complexities of the financial landscape confidently, fostering a community of financially savvy and empowered users.

Seamless Integration of Security Measures

Understanding the paramount importance of data security and privacy, SelfyConto integrates state-of-the-art security measures and protocols to ensure the protection of users’ sensitive financial information. By leveraging robust encryption technologies, multi-factor authentication, and continuous monitoring, the platform guarantees a secure and reliable banking experience for its users, mitigating the risks associated with online transactions and safeguarding against potential cyber threats. SelfyConto’s steadfast commitment to data security reinforces user trust and confidence, establishing it as a benchmark for secure and reliable digital banking services.

A Vision for Inclusive Digital Banking

Privind înainte, SelfyConto envisions a future where digital banking is synonymous with inclusivity, accessibility, and transparency. By fostering an environment of financial empowerment and sustainable growth, the platform seeks to bridge the gap between traditional banking practices and modern digital solutions, catering to a diverse clientele and their unique financial aspirations. SelfyConto’s vision for inclusive digital banking embodies the ethos of financial democratization, where individuals from all walks of life can access personalized financial solutions and embark on a journey of financial prosperity and independence, thus reshaping the landscape of the banking industry for generations to come.

SelfyConto stands as a testament to Banca Mediolanum’s pioneering spirit and commitment to leveraging technology for the betterment of the banking experience. With its user-friendly interface, comprehensive suite of financial services, and emphasis on sustainability, SelfyConto exemplifies the convergence of digital innovation, financial expertise, and customer-centricity. As the financial landscape continues to evolve, SelfyConto remains at the forefront of digital banking, setting new benchmarks for convenience, accessibility, and financial empowerment. By redefining the contours of contemporary banking, SelfyConto paves the way for a more inclusive and digitally-driven financial future.