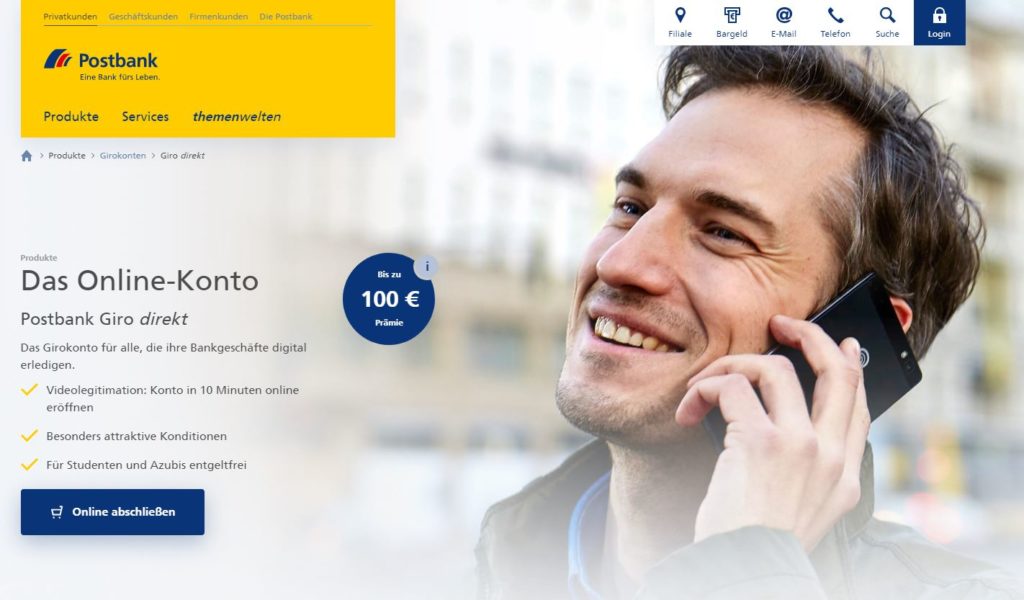

In an increasingly digital age, the realm of banking has undergone a significant transformation. One notable player in this evolution is Postbank, a subsidiary of Deutsche Bank AG, offering a range of financial services. Among these services, the “Giro direkt” stands out as an innovative online banking solution that caters to both personal and student clientele. In this comprehensive article, we will delve into the features, benefits, and the impact of Postbank’s Giro direkt on modern banking experiences.

A Streamlined Banking Solution

Postbank’s Giro direkt is a testament to the changing landscape of banking, embracing the power of technology to simplify financial management. With the ability to open an account entirely online and through a video identification process, Postbank has removed the need for in-person visits, expediting the account setup process. This innovation underscores the convenience and efficiency that modern consumers demand.

Student-Focused Advantage

One of the most remarkable features of Giro direkt is its dedication to students and apprentices. As education and career paths become more diverse, financial institutions are recognizing the unique needs of these demographics. Giro direkt offers these individuals a fee-free option, acknowledging the financial constraints they often face during their studies. This student-focused approach aligns with the broader trend of tailored banking solutions to suit specific life stages.

Transparent Fee Structure

Postbank’s commitment to transparency is reflected in the Giro direkt’s fee structure. The monthly account management fee is clearly outlined, with an entgeltfrei (free) option for students and apprentices. This approach eliminates any ambiguity and empowers customers to make informed decisions about their banking choices. Additionally, the clarity surrounding other charges and fees, such as the Verwahrentgelt on higher balances, further demonstrates Postbank’s dedication to open communication.

Accessible Cash Management

Giro direkt’s integration with an extensive network of ATMs and partner locations for cash withdrawals is a testament to its accessibility. Customers can access their funds conveniently at Postbank ATMs, participating Shell gas stations, and other Cash Group ATMs. Moreover, the inclusion of cashback options at participating retailers provides an added layer of convenience for account holders who require access to cash on the go.

Embracing Digital Identity Verification

The digital era has brought forth innovations that redefine traditional processes, and Postbank’s Giro direkt exemplifies this through its video identification process. By leveraging video-chat technology, customers can open an account without visiting a physical branch. This practice aligns with the modern customer’s desire for streamlined, efficient, and remote services, effectively bridging the gap between online convenience and real-world security.

Empowering Financial Independence

Giro direkt’s impact extends beyond convenience and accessibility; it also promotes financial independence. By offering a platform where individuals can manage their finances online, Giro direkt empowers customers to take control of their money at their own pace. This approach aligns with the growing emphasis on financial literacy and self-sufficiency, allowing customers to monitor transactions, set up transfers, and gain insights into their spending habits without relying on traditional bank visits.

Navigating the Global Landscape

In an increasingly interconnected world, the need for banking services that transcend borders is crucial. Giro direkt’s integration with international payment networks, such as the Mastercard network for overseas usage, addresses the evolving requirements of a global society. The transparent fee structure for international transactions, along with the inclusion of currency conversion details, demonstrates Postbank’s commitment to making cross-border financial activities seamless and transparent.

Customer-Centric Evolution

Giro direkt exemplifies how Postbank has embraced a customer-centric approach to banking. By offering tailored solutions for students and apprentices, addressing the needs of diverse clientele, and enabling digital interactions through features like video identification, Postbank demonstrates its willingness to evolve with the changing demands of its customers. This adaptability is a hallmark of customer-centric design that places individuals’ preferences and convenience at the forefront.

Contributing to Digital Transformation

Postbank’s Giro direkt is not just an isolated service; it represents a contribution to the broader digital transformation within the banking industry. As more financial institutions integrate online services, video identification, and seamless digital transactions, the entire sector is moving toward a future where traditional brick-and-mortar banking is no longer the sole norm. Giro direkt’s success serves as a model for other banks to follow suit, thereby shaping the industry landscape toward a more technologically advanced and customer-friendly direction.

A Holistic Banking Ecosystem

Giro direkt’s integration into Postbank’s suite of services creates a holistic financial ecosystem for customers. From Girokonten to Wertpapierdepot (securities accounts) and Wertpapiere & Sparen (securities and savings), customers can manage various aspects of their finances within a single institution. This approach not only simplifies financial management but also encourages long-term relationships between customers and the bank.

In the ever-evolving landscape of modern banking, Postbank’s Giro direkt stands as a testament to the power of innovation and customer-centric design. Through its user-friendly online account setup, tailored benefits for students, transparent fee structure, and commitment to digital identity verification, Giro direkt showcases the potential of banking in the digital age. As customers continue to seek seamless, efficient, and personalized banking experiences, Giro direkt serves as a prime example of how financial institutions can meet and exceed these expectations.