C24 Bank: A New Era of Digital Banking

Pioneering Digital Financial Solutions

C24 Bank is at the forefront of the digital banking revolution, providing customers with a fully online banking experience that is both intuitive and accessible. The bank leverages cutting-edge technology to offer a wide array of services, from everyday banking to advanced financial management tools. With a focus on innovation, C24 Bank continually enhances its offerings to meet the changing needs of its customers, ensuring that they have access to the latest and most efficient financial solutions. Whether managing day-to-day expenses, saving for the future, or investing in new opportunities, C24 Bank provides the tools needed to achieve financial goals with ease.

Security and Trust at the Core

In the digital world, security is paramount, and C24 Bank places a strong emphasis on safeguarding customer data and transactions. The bank employs state-of-the-art security measures, including encryption, multi-factor authentication, and continuous monitoring, to protect against fraud and unauthorized access. This commitment to security ensures that customers can bank with confidence, knowing that their personal and financial information is protected at all times. C24 Bank’s reputation for reliability and trustworthiness makes it a preferred choice for those seeking a secure and efficient banking experience.

Explore C24 Bank’s Comprehensive Product Range

Everyday Banking Made Simple

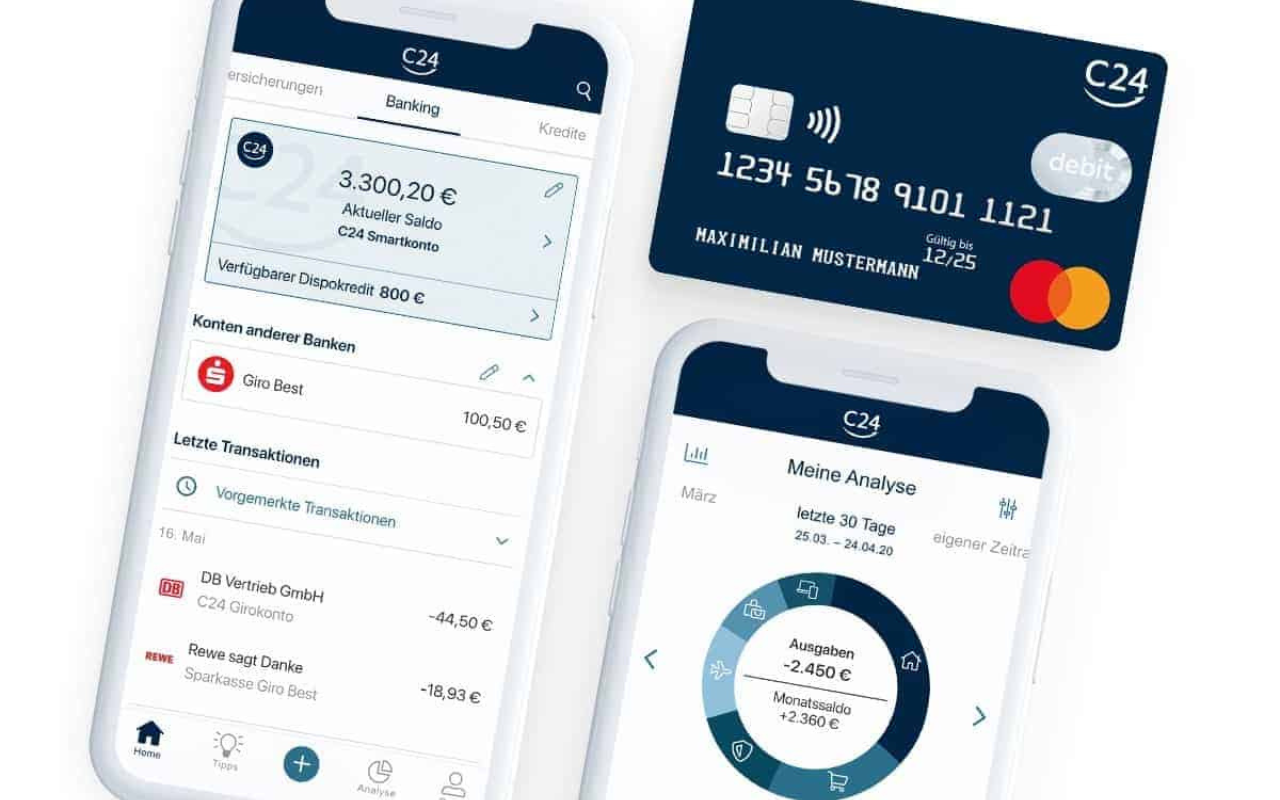

C24 Bank offers a suite of everyday banking services designed to make managing finances effortless. With a user-friendly mobile app and online platform, customers can easily access their accounts, transfer funds, pay bills, and monitor their spending, all from the convenience of their smartphone or computer. The bank’s real-time transaction alerts and spending insights help customers stay on top of their finances, providing greater control and transparency. Additionally, C24 Bank’s competitive fees and favorable exchange rates make it an attractive option for those who want to maximize their money without the hidden costs associated with traditional banks.

One of the standout features of C24 Bank is its integrated budgeting tools. These tools allow customers to set spending limits, track their expenses by category, and receive personalized recommendations on how to save more effectively. By offering these features, C24 Bank empowers its customers to take charge of their financial well-being and make informed decisions about their money.

Savings and Investments: Building a Brighter Future

C24 Bank understands the importance of saving and investing for the future, which is why it offers a range of savings accounts and investment options tailored to different financial goals. Whether saving for a rainy day, planning for retirement, or looking to grow wealth through investments, C24 Bank provides the flexibility and guidance needed to make those goals a reality.

The bank’s high-yield savings accounts offer competitive interest rates, allowing customers to earn more on their deposits while maintaining easy access to their funds. For those interested in investing, C24 Bank offers a variety of investment products, including stocks, bonds, and mutual funds, all accessible through its user-friendly platform. With expert advice and educational resources available, C24 Bank ensures that customers have the knowledge and tools they need to make smart investment decisions.

C24 Bank’s Unique Services and Benefits

Personal Loans and Credit Services

C24 Bank’s personal loan and credit services are designed to provide customers with the financial flexibility they need, whether financing a major purchase, consolidating debt, or covering unexpected expenses. The bank offers competitive interest rates and flexible repayment terms, making it easy for customers to find a loan that fits their needs and budget.

The application process is straightforward and can be completed entirely online, with quick approval times and transparent terms. Additionally, C24 Bank’s credit services include credit cards with rewards programs, offering cashback, travel points, and other perks that make spending more rewarding. By offering these financial products, C24 Bank helps customers achieve their financial goals while enjoying the benefits of modern banking.

Seamless International Banking

For customers with global financial needs, C24 Bank offers seamless international banking services that make managing money across borders simple and cost-effective. The bank provides multi-currency accounts, competitive exchange rates, and low fees on international transfers, ensuring that customers can send and receive money anywhere in the world without the usual hassles and costs.

C24 Bank’s international debit and credit cards are widely accepted and offer additional benefits such as travel insurance and no foreign transaction fees, making them the perfect companion for international travel and online shopping. With these services, C24 Bank caters to the needs of global citizens, expatriates, and frequent travelers, offering a banking experience that keeps pace with their dynamic lifestyles.

Why Choose C24 Bank?

A Bank That Puts Customers First

C24 Bank is committed to providing a banking experience that puts customers first. The bank’s customer-centric approach is reflected in its easy-to-use platforms, transparent fees, and personalized services. Whether offering tailored financial advice, flexible products, or 24/7 customer support, C24 Bank goes above and beyond to ensure that every customer feels valued and supported.

The bank’s dedication to customer satisfaction extends to its ongoing development of new features and services, based on customer feedback and changing market trends. By staying attuned to the needs of its customers, C24 Bank continues to deliver innovative solutions that make banking more convenient, efficient, and rewarding.

A Future-Focused Approach

C24 Bank is more than just a bank—it’s a forward-thinking financial partner that embraces the future of banking. With a focus on digital innovation, C24 Bank is constantly exploring new ways to enhance the banking experience through technology. Whether integrating artificial intelligence for personalized financial advice or adopting blockchain technology for secure transactions, C24 Bank is always at the cutting edge of financial technology.

This future-focused approach ensures that customers have access to the latest tools and services that make managing money easier and more efficient. By choosing C24 Bank, customers are not only gaining access to a full range of banking services but also partnering with a bank that is committed to leading the way in the digital banking revolution.

Final Thoughts: Experience the Future of Banking with C24 Bank

C24 Bank is redefining the way people think about banking by offering a comprehensive range of digital financial services that combine convenience, security, and innovation. With a commitment to customer satisfaction, a focus on technological advancement, and a wide array of products designed to meet diverse financial needs, C24 Bank is setting a new standard in digital banking. Whether managing daily expenses, saving for the future, or navigating international finances, C24 Bank provides the tools and support needed to achieve financial success in today’s fast-paced world. Explore the world of C24 Bank and discover how it can help you take control of your financial future with confidence and ease.