Borrowell, a leading credit education company in Canada, revolutionizes how Canadians manage their finances by offering free credit scores and personalized financial advice. With over 3 million satisfied members, Borrowell stands out as the first company in Canada to provide free credit score monitoring, making financial wellness accessible to everyone. This comprehensive article explores Borrowell’s services, benefits, and how it helps Canadians achieve their financial goals.

What is Borrowell?

Borrowell is a proudly Canadian fintech company that provides free credit scores, personalized financial product recommendations, and tools to help Canadians improve their financial health. By leveraging advanced technology and partnerships with over 50 financial institutions, Borrowell offers a wide range of services including personal loans, credit cards, mortgages, and more.

Key Features of Borrowell

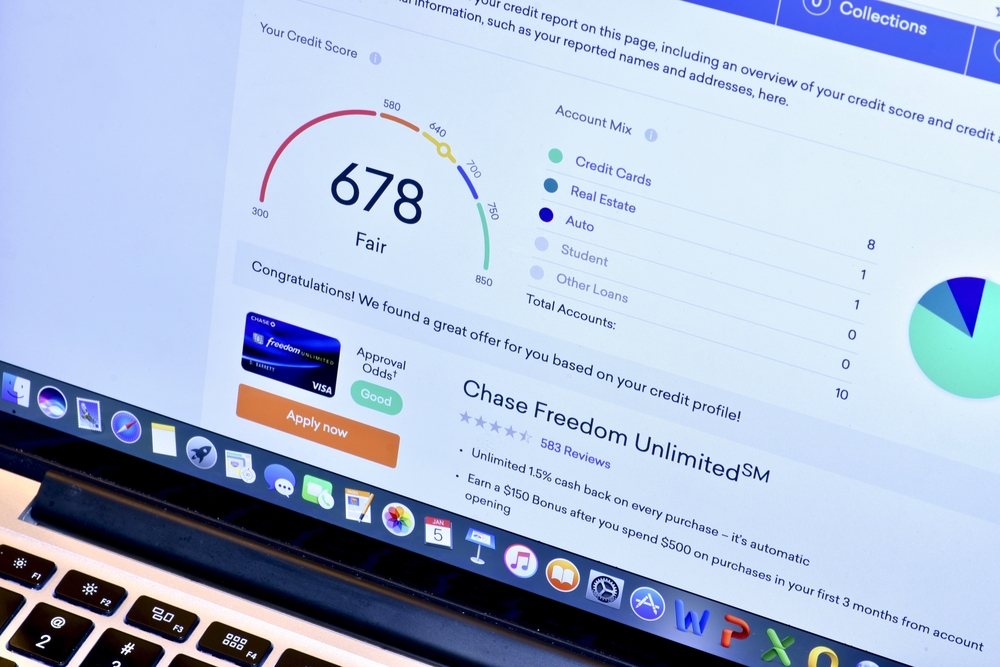

Free Credit Score and Report

Borrowell provides free access to your Equifax credit score and credit report. With weekly updates, you can monitor your credit score, track changes, and understand factors affecting your credit health without any impact on your score.

Credit Improvement Education

Borrowell offers the first AI-powered Credit Coach in Canada, which provides personalized tips and education to help you improve your credit score. The Credit Coach analyzes your credit profile and gives actionable advice to enhance your financial standing.

Personalized Financial Product Recommendations

Based on your credit profile, Borrowell suggests financial products that suit your needs. From credit cards to personal loans, you can compare options from over 75 partners to find the best fit for your financial situation.

Bank-Level Security

Security is a top priority at Borrowell. The platform uses 256-bit encryption to ensure that your personal information is protected with bank-level security standards.

How Borrowell Works

Sign Up Process

Joining Borrowell is simple and takes just three minutes. Sign up for free to access your Equifax credit score and report. Once registered, you’ll receive weekly updates and personalized financial advice.

Monitoring and Education

Borrowell offers free weekly credit score tracking and comprehensive credit reports. The AI-powered Credit Coach helps you understand your credit score, provides tips for improvement, and educates you on financial best practices.

Product Recommendations

Borrowell’s platform analyzes your credit profile and recommends financial products tailored to your needs. Whether you’re looking for a new credit card, a personal loan, or the best mortgage rates, Borrowell helps you find the right product.

Why Canadians Love Borrowell

Borrowell has earned the trust of over 3 million Canadians due to its commitment to transparency, education, and personalized service. Here are the top reasons why Borrowell is a favorite:

- Free Credit Score Tracking: Access your credit score and report for free, with no impact on your credit score.

- Personalized Financial Advice: Receive tailored recommendations and tips to improve your financial health.

- Bank-Level Security: Your personal information is protected with the highest security standards.

- Educational Resources: Borrowell provides valuable educational content to help you understand and improve your credit.

- No Hard Credit Hits: Checking your credit score with Borrowell won’t hurt it.

Customer Testimonials

Borrowell’s impact is reflected in the positive feedback from its users. Here are some testimonials from happy customers:

- Courtney M. – “Love this! I was a little skeptical at first but it tells you who you still owe and how much. Currently using this to view my credit and pay off what I owe.”

- Andrea B. – “I have been using Borrowell for over a year now and I am a happy customer. I get the real deal on my credit and good advice also!”

- Ashvin G. – “Excellent service. Recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purpose.”

Financial Products Offered by Borrowell

Borrowell partners with over 50 financial institutions to offer a variety of financial products tailored to your needs:

Personal Loans

Borrowell helps Canadians access personal loans that fit their financial profile. Whether you need to consolidate debt or finance a large purchase, Borrowell’s loan recommendations can help you find the best rates and terms.

Credit Cards

Find the best credit card for your needs with Borrowell’s personalized recommendations. Compare options based on rewards, interest rates, and other features to choose the right card for your financial goals.

Mortgages

Borrowell allows you to compare mortgage rates from various providers, helping you find the best deal. Whether you’re buying your first home or refinancing, Borrowell makes the process easier and more transparent.

Banking and Insurance

In addition to loans and credit cards, Borrowell offers recommendations for bank accounts and insurance products. Find the right banking solutions and insurance coverage to meet your financial needs.

Educational Resources

Borrowell is committed to helping Canadians improve their financial literacy. The platform offers a wealth of educational resources, including articles, tips, and guides on topics such as:

- How to Improve Your Credit Score: Practical steps to enhance your credit score and increase your chances of approval for financial products.

- Credit Scores vs. Credit Reports: Understanding the differences between credit scores and credit reports and how each impacts your financial health.

- Impact of Late Payments: How late payments affect your credit score and what you can do to mitigate the impact.

- Reading Your Credit Report: A comprehensive guide to understanding and interpreting your credit report.

Conclusion

Borrowell is a valuable resource for Canadians seeking to take control of their financial health. With free credit scores, personalized financial advice, and a wide range of financial products, Borrowell empowers users to make informed decisions and achieve their financial goals. Join the 3 million Canadians who trust Borrowell and start your journey to better financial health today. Sign up for free and explore the benefits of this innovative platform.